Digital wallets are no longer a “nice-to-have” feature. For modern brands in FoodTech, retail, and FinTech, they’re a must-have tool for increasing customer lifetime value, powering loyalty programs, and keeping full control over the mobile payment experience. Unlike generic payment gateways, a custom digital wallet development can help you retain users, automate refunds, and localize promotions - all from one secure backend.

At Railwaymen, we’ve partnered with brands like Shawarmer or Alamar Foods and supported large-scale mobile wallet services as strategic technology partners - delivering scalable, PCI-ready digital wallet solutions across MENA and beyond, with millions of transactions processed monthly. In this guide, you'll learn how to build your own digital wallet that delivers measurable business value.

-

Learn how to build a PCI-ready electronic wallet with customer loyalty modules, auto-refunds and Mixpanel tracking

-

Designed for brands in MENA, retail, FoodTech

-

Modular, secure, API-first. No vendor lock-in

Explore our Digital Wallet Offer

Table of Contents:

1. What Is a Digital Wallet App (And What It’s Not)?

2. Key Business Use Cases (Why Brands Build E-wallet apps)

3. Modular Architecture That Scales

4. Digital wallet Features Modules

5. How It Works: Mobile Wallet Tech Stack Integration Layers

6. How to Keep Your Digital Wallet Safe?

7. GCC vs Global Market Considerations

9. Build vs Buy: Why Custom Matters

10. Digital Wallet Trends: What’s Shaping the Future?

11. Why ISO 27001 Certification Matters in Digital Wallet Development

12. Wallet ROI Calculator: What Can You Gain?

What Is a Digital Wallet App (And What It’s Not)?

A digital wallet is a secure, software-based system that stores users'’ payment information and enables transactions through mobile devices or web applications. Unlike traditional payment gateways that only process payments, e-wallets can store value, integrate with loyalty systems, collect transaction history, and support internal transfers, cashback, or points-based incentives. By accepting digital wallet payments, businesses can enhance mobile conversion rates by streamlining the checkout process, reducing the likelihood of abandoned carts.

Digital wallet applications fall into several categories:

-

Closed-loop wallets – usable only within a specific brand ecosystem (e.g. Starbucks Rewards app)

-

Open-loop wallets – interoperable with multiple external systems (e.g. Apple Pay, PayPal)

-

Multi-brand wallets – one backend, customized per brand or region (e.g. food franchise networks)

A custom digital wallet is a modular, brand-controlled environment enabling full ownership of customer data, online payments, and loyalty programs.

Read how loyalty drives wallet value

Key Business Use Cases (Why Brands Build E-wallet apps)

Loyalty Retention

Read our article on mobile wallet loyalty programs to understand how real brands increase repeat usage.

Digital wallets enable brands to create powerful loyalty ecosystems: cashback, points, tier-based incentives, and limited-time coupons. Integrating a loyalty program into an e-wallet app can enhance user experience by consolidating multiple loyalty cards for easier access. Clients like Alamar Foods reported a 25% increase in repeat orders thanks to e-wallet-exclusive promos.

Refunds Compensations

Instead of processing slow, external refunds, custom ewallets enable automated compensation workflows. In case of our strategic partner, late delivery refunds are credited to the user’s mobile wallet within seconds - improving satisfaction and reducing support tickets.

Additionally, users can monitor their bank account balance in real-time within the e-wallet app, ensuring they have sufficient funds for transactions.

Franchise Multi-brand Operations

Custom ewallets can operate across multiple brands or regions with individual promo logic, language settings, or tax/VAT configuration – all managed under a unified admin panel.

Users can manage multiple wallets to separate personal and business transactions or to address different financial needs, providing flexibility and better organization.

Data Ownership Customer Insights

By controlling the mobile wallet software backend, brands retain access to transactional data, enabling advanced segmentation, Mixpanel integration, and targeted re-engagement based on user behavior.

E-wallets can safeguard digital assets, including cryptocurrencies, by providing secure storage and efficient management solutions, which are crucial for businesses handling crypto assets.

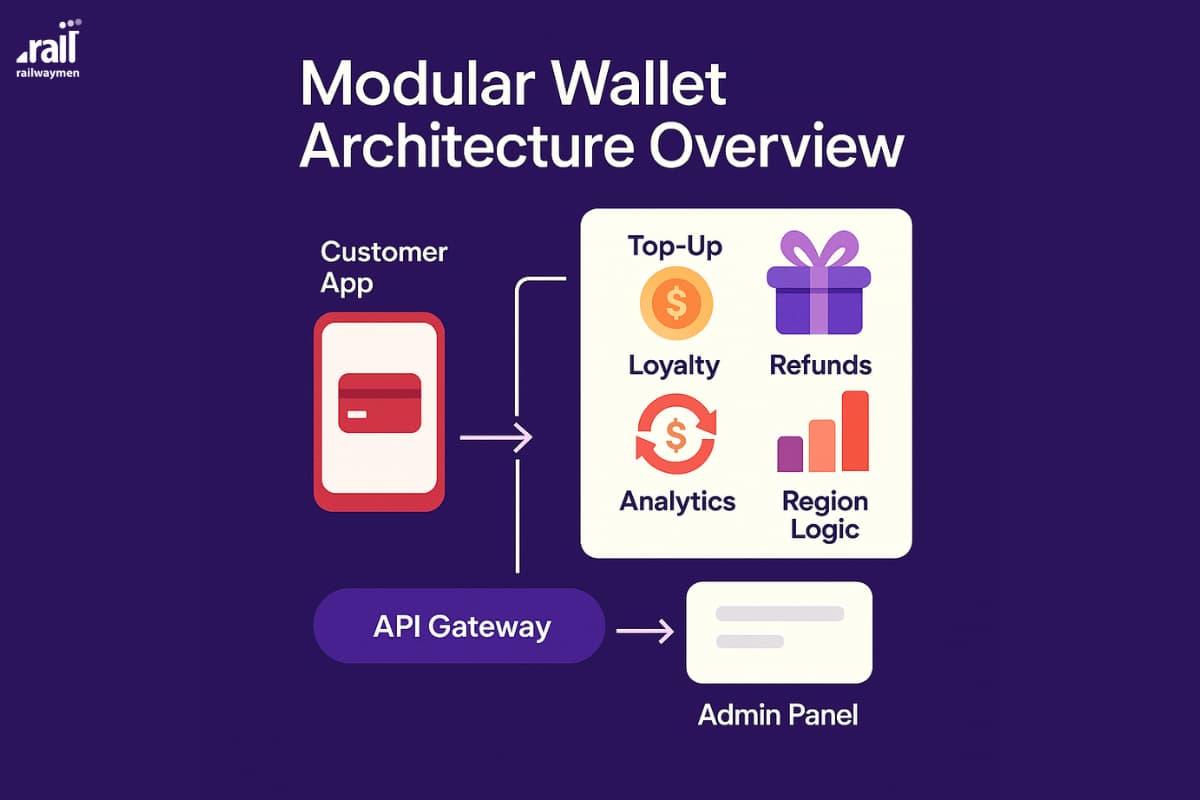

Modular Architecture That Scales

Railwaymen’s digital wallet app development service is designed with scalability and flexibility in mind. It follows an API-first, secure-by-design model, compliant with PCI DSS and ISO 27001 standards. This enables seamless integration with mobile apps, POS systems, and regional payment gateways.

Mobile wallet integration with various payment solutions like Google Pay and Apple Pay enhances user experience and security by leveraging robust APIs and ensuring secure transactions.

Modular wallet architecture allows brands to plug in or remove loyalty, analytics, or refund logic without rewriting the system.

Key characteristics:

-

API-first: ready for mobile devices & frontend flexibility

-

Microservices-ready: scale modules independently

-

Secure-by-design: PCI-ready, encrypted storage

-

Region-aware: Arabic RTL, multi-currency, tax-compliant

Explore our ewallet development solutions

Digital wallet Features Modules

Railwaymen provides pre-built modules that reduce time-to-market:

Top-Up Methods

Balance reload via digital payment methods such as Moyasar, STC Pay, Mada, voucher codes, or credit and debit cards.

Redeem Transfer

Users can redeem points or transfer value within the app.

Loyalty Engine

Points, cashback, QR-code coupons, tier logic.

Expiry Rules

Promo or cashback expiry based on time or usage.

Admin Panel

Explore our e-wallet UX and mobile design tips to understand how admin and user roles impact daily performance.

Role-based permissions, region management, and campaign builder.

Compensation Engine

Customer service teams issue credit instantly.

Analytics Layer

Mixpanel-ready events, dashboards per brand/region.

These modules are tailored to different industries, especially food delivery, QSR, retail loyalty, and custom FinTech platforms.

How It Works: Mobile Wallet Tech Stack Integration Layers

Our wallet apps are built using a modular architecture that supports fast deployment, secure operations, and robust integrations, which are crucial aspects of ewallet software development. Below are the core technical components that power our solutions:

-

API Gateway – RESTful APIs for top-up, redeem, user wallet status, and admin controls. All endpoints are documented and versioned.

-

Authentication Layer – Token-based access with OAuth2.0 and role-based permissions for mobile apps, admin panel, and third-party systems.

-

Webhooks Callbacks – Real-time notifications for events such as balance updates, refund triggers, or campaign expiry.

-

Integration Adapters – Native integration modules for:

- Moyasar – Payment gateway for Mada, STC Pay, Visa

- STC Pay – QR, in-app, and direct mobile wallet top-up

- Mixpanel – Custom events for user wallet behavior

- POS Systems – For syncing in-store transactions and loyalty events

-

Infrastructure – Deployed on ISO 27001-certified cloud environments with:

- 99.9% SLA uptime

- Encrypted data storage (AES-256)

- Kubernetes-based scaling per module (loyalty, promo, analytics)

-

Monitoring Logs – Prometheus/Grafana dashboards and error logging for observability

How to Keep Your Digital Wallet Safe?

This infrastructure ensures rapid onboarding, stability under high concurrency, and compliance across regulatory environments in MENA and globally.

Security is non-negotiable when it comes to mobile wallet development. As digital wallets handle sensitive data such as payment credentials, loyalty points, and transaction histories, they must meet strict cybersecurity standards. At Railwaymen, all wallet solutions are designed following PCI DSS compliance guidelines and utilize AES-256 encryption for data at rest, alongside TLS 1.3 for secure communication.

To further protect user data, we implement OAuth 2.0-based authentication, role-based permissions, and multi-layered access controls. Additionally, our wallet infrastructure runs in ISO 27001-certified cloud environments, ensuring full compliance with international security best practices.

Railwaymen is proud to hold the ISO/IEC 27001 certification, a globally recognized standard for information security management. This guarantees that we follow rigorous internal protocols for data protection, risk management, and incident response - critical for enterprise clients handling high transaction volumes.

GCC vs Global Market Considerations

KSA UAE require localized integrations with financial institutions:

-

Moyasar: gateway supporting Mada, Visa, STC Pay

-

STC Pay: mobile-first digital wallet preferred by Saudi users

-

RTL Language Support: all UI must support Arabic layout

-

Compliance: mobile wallet apps operations must align with local tax (ZATCA), KYC, and invoice rules

In global markets like the US or Europe, Stripe, Apple Pay, and Google Pay dominate – but these offer less flexibility in loyalty, branding, or refund workflows. Custom mobile wallets fill this gap with deeper customer engagement.

In GCC, in-app wallets outperform Stripe due to local methods like STC Pay and Arabic interface expectations.

See how digital wallets shape FoodTech strategies

Read how multiple digital wallets fit FoodTech ecosystems

Case Study Highlights

NDA strategic partner (GCC)

We collaborated with one of the GCC strategic foodtech partner to deliver a scalable mobile wallet infrastructure and integrate a mobile banking app for millions of users across KSA. The system enabled:

-

Region-based promo rules

-

Expiry logic per offer

-

Real-time refund engine integrated into their app and backend

Shawarmer

Shawarmer needed a loyalty engine with flexible campaign logic. We delivered:

-

QR-based promos with cashback

-

Tiered rewards linked to user activity

-

Role-based admin dashboard to launch track campaigns

European QSR Client

This wallet supported POS-integrated loyalty systems used in physical locations.

This project involved POS-integrated wallet logic for quick service restaurants. Key features included:

-

Top-up via in-store QR

-

Loyalty tiers (bronze, silver, gold)

-

Admin dashboard with region-specific analytics

Explore Railwaymen Custom Digital Wallet Experience

Build vs Buy: Why Custom Matters

Should you build a custom ewallet or rely on off-the-shelf platforms like Stripe or Apple Pay? Here's how to decide:

Build:

-

Full ownership of data and user experience

-

Integrations tailored to your region (e.g. STC Pay, Mada)

-

Scalable loyalty and promo features

-

PCI-compliant backend ready for multi-brand/franchise use

Buy/Use 3rd-party:

-

Fast start, but limited customization

-

Lack of control over refund/promo logic

-

High fees per transaction (esp. in GCC)

-

Dependency on external ecosystem

Verdict: If your brand runs in competitive, high-frequency categories like FoodTech, QSR, Fintech or ecommerce - owning the wallet is a competitive edge.

Digital Wallet Trends: What’s Shaping the Future?

The e-wallet ecosystem is evolving fast, and 2025 brings several transformative trends for brands looking to stay ahead:

-

Embedded finance super apps: Wallets are no longer standalone - they’re integrated into broader digital experiences like food delivery, ride-hailing, or even healthcare.

-

Tokenization virtual cards: More wallets now offer single-use virtual cards, increasing privacy and fraud resistance.

-

Biometric authentication: Fingerprint and face ID logins are becoming standard for mobile wallet apps, reducing friction while enhancing security.

-

AI-powered insights: Wallets now utilize user behavior data to offer predictive promotions and personalized financial suggestions.

Custom wallets allow brands to capitalize on these trends while maintaining full control over how and when new modules are implemented.

Why ISO 27001 Certification Matters in Digital Wallet Development

In a time when digital payments are under constant threat from cyberattacks, the importance of information security certifications cannot be overstated. ISO/IEC 27001 is the international gold standard for establishing, implementing, maintaining, and continually improving an Information Security Management System (ISMS).

Railwaymen’s ISO 27001 certification means that we don’t just build secure systems - we live by secure processes. This includes ongoing staff training, regular audits, incident simulations, and continuous monitoring of infrastructure and applications. For enterprise-level digital wallets - especially in regulated markets like the GCC, EU, or FinTech-heavy sectors - ISO 27001 offers an added layer of trust and legal compliance.

Whether you're managing loyalty data, processing refunds, or syncing POS payments, partnering with an ISO 27001-certified software house ensures that your wallet is developed with security-first thinking from day one.

Wallet ROI Calculator: What Can You Gain?

Digital wallet application development is not just a cost - it is a long-term asset. Here's how custom mobile wallet generate ROI:

Wallet ROI Calculator: What Can You Gain?

Digital wallets are not just a cost - they’re a long-term asset. Here's how they generate ROI:

| Revenue Impact | Metric |

| Increased repeat orders | +25% (based on one of our client's wallet users) |

| Decreased refund handling costs | -30% support ticket volume |

| Loyalty redemption boost | Avg 60–70% monthly promo usage |

| Time to break even | 3–6 months (custom MVP wallet build) |

Cost of Not Owning Your Wallet App

Many brands overlook the hidden costs of relying solely on gateways or generic solutions:

-

You don’t own customer data - Stripe or Apple Pay does.

-

No control over promo personalization - can’t target by region, brand, or tier.

-

External refund delays - increase churn, reduce NPS.

-

Fees accumulate - even 1.5–2.5% per transaction adds up fast at scale.

In short: if you don’t own the mobile wallet app, you pay for it indirectly - in loyalty, control, and customer experience.

FAQ + Glossary

What is a PCI wallet? A PCI wallet follows Payment Card Industry standards (DSS 3.2.1) for encrypted payment data storage and processing.

How does cashback work in wallets? Users earn a % of their transaction as balance or points; usable on next order, or auto-applied.

What is region logic? Rules per country: tax, language, currency, promo expiry. Example: 5% cashback in UAE, 10 SAR voucher in KSA.

Wallet vs Gateway? Gateway processes transactions only; wallet stores value, powers loyalty, and integrates refunds and analytics.

What’s a modular wallet? A wallet built from plug-in components (top-up, loyalty, admin), which can evolve with product needs.

Let’s Build It Together

Your customers expect more than just payments - they want value, rewards, and seamless service. A custom digital wallet can deliver all of that.

Book a session with our fintech team and see how we delivered success to brands across MENA and beyond.

.png)