Triple Tied Out

Automated Daily Financial Audits for Property Managers

WEB APP

ABOUT PROJECT

About the project:

Discover the story of the app that turned hours of manual financial auditing into an effortless daily routine for property managers across the industry.

The Problem: When a Legacy App Stifles Growth:

Despite using modern property management systems, many real estate firms lacked tools for consistent, automated financial reconciliation. Manual audits were slow, error-prone, and lacked transparency – making it hard to build trust with stakeholders, owners, or regulators.

Where did the idea for building TTO come from

The idea for creating TTO was born from the users themselves.

Our clients actually asked us for it! This is the best way to build a tech product when your clients are asking for it and willing to pay for it!

Taylour Hou

Chief Happiness Officer, Triple Tied Out

OUR WORK

Frontend

Backend

1. PROCESS

The development process was driven directly by client demand — Triple Tied Out’s users needed a solution that didn’t exist on the market. We started with strategic discovery to align around their unique audit logic and compliance needs, then designed a multi-layered system to automate the most error-prone tasks: reconciliations, liabilities, and balance checks. Given the lack of standardized APIs, much of the platform’s backend relies on robust scraping and parsing techniques, built to handle high variability in document formats. All features were prioritized around one goal — transforming a manual, hours-long process into a reliable, automated daily routine for property managers. The project team consisted of:

1 x Product

Manager

2 x Frontend Developers

1 x Backend Developer

Adam, Ruby on Rails Developer

“The main goal of the application (Tripletiedout) is to support users in their daily work by automating repetitive processes. The application consists of many subsystems including web scraping, handling incoming e-mails and cooperation with external apps. The most difficult thing is to maintain correct operation of all subsystems, on which users’ work depends to a large extent, and at the same time one cannot rely on the stability of external data sources.”

2. THE FEATURES

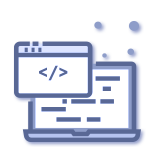

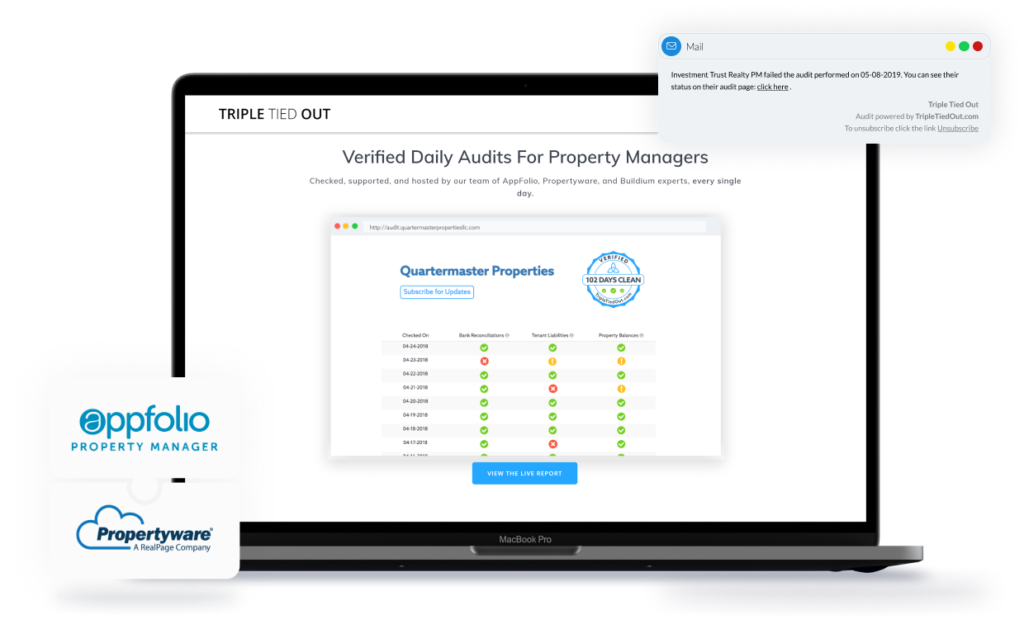

AUDIT GENERATOR

Bank reconciliations Make sure that your recs are in balance, up to date, and that there are no uncleared deposits or expired checks.

Tenant liabilities Double check that you have enough cash to cover security deposits and prepayments.

Property balances

Ensure that all of your properties are staying in the positive to prevent commingling.

Badge Verified Daily Audits

After audits, you can share your badge on your website to potential investors and owners. This is valuable information for people who want to do business with you. It communicates your transparency and the value of working with your company.

Marcin, Senior Ruby on Rails Developer

“Application seems to be simple but under the hood there is a complicated logic, many integrations with external apis like Google drive, Sendgrid, Plivo, Asana, Stripe and more. The most difficult part of the project was to prepare failure-free PDF parsers that will allow the system to the data we need.”

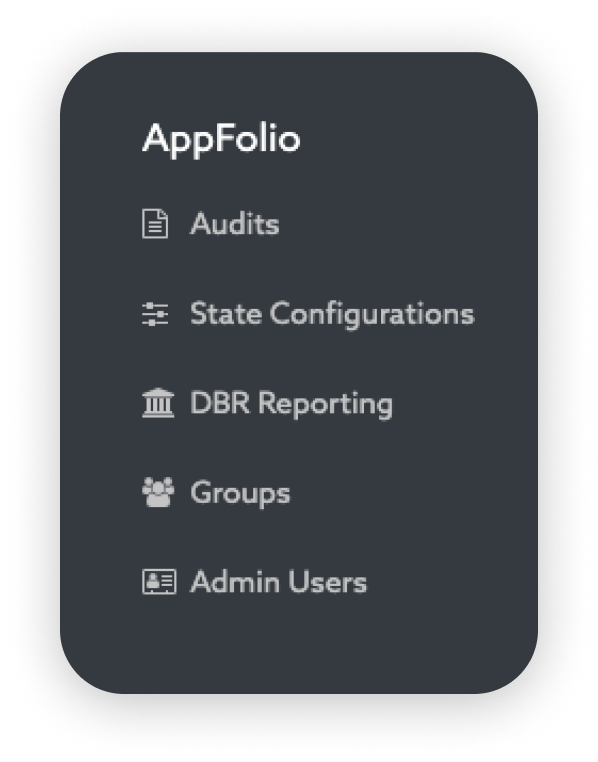

INTEGRATIONS WITH PROPERTY MANAGEMENT SYSTEMS AND BANKS

To deliver daily financial audits at scale, Triple Tied Out connects seamlessly with banks and property management systems, even in cases where no official APIs exist. The platform processes thousands of PDF bank statements using custom-built, fault-tolerant parsers and reverse engineering techniques. Through integrations with tools like Google Drive, Stripe, and Asana, it automates payment tracking, document syncing, and task management – turning once-fragmented financial workflows into a unified, real-time audit system. This deep integration layer ensures accuracy, regulatory compliance, and full audit transparency for property managers.

PDF EXPORT

Each completed audit can be exported as a structured PDF file — ready to share with auditors, stakeholders, or compliance bodies. The exports are automatically generated from verified data, ensuring consistency and reducing manual errors.

Designed for real-world use, the PDFs include audit results, account balances, exceptions, and the Verified Audit Badge, making them a transparent and professional communication tool.

Exporting happens on demand or on schedule — allowing property managers to meet reporting obligations without lifting a finger.

Szymon, Junior Ruby on Rails Developer

“Working on ApMHELP is a constant challenge requiring from us developers a lot of attention and extensive knowledge of services with which we are integrated, and the ability to quickly adapt to changes occurring in these services. Additionally, when creating various solutions automating the auditing process we need to demonstrate our Reverse-Engineering skills in order to effectively obtain data without direct access to the API. “It is surprising how much can be found in JavaScript”

USER INTERFACE

NOTIFICATIONS

Through the User Panel (also called Customer Portal), subscribers can view available content documents and control the sending of individual emails. Managers with proper permissions can add new customers, and by using the drag & drop method, determine in which column a particular client should be located.

3. TECHNOLOGIES & INTEGRATIONS

FINAL PRODUCT

RESULTS & FURTHER DEVELOPMENT

Triple Tied Out has become a trusted daily tool for hundreds of property managers, automating critical financial audits and boosting transparency across the real estate sector. The platform reduced manual work from hours to minutes, helping clients stay compliant and audit-ready at all times. The Verified Audit Badge increased stakeholder trust by offering public proof of financial health, supporting both investor relations and internal governance. As adoption grows, the roadmap includes deeper integrations with PMS platforms and additional analytics features — turning financial audits into a strategic asset, not just a compliance checkbox.

Testimonial:

I’ve been working with Railwaymen since 2012 across multiple projects and companies. I trust them and bring them in whenever I can.

Taylor Hou,