FreshPay

Developing comprehensive software for automating payroll processing for accountants, employers and employees in the UK

web app

FreshPay is a payroll management system that allows to settle payslips more efficiently than

before, in full compliance with UK legislation.

ABOUT PROJECT

About the company

FreshPay is a UK company founded with the goal of streamlining Cloud Payroll Software. Founded by three experienced accountants, the company was created to make payroll operations easier by automating the process. FreshPay offers its clients a solution that streamlines standard payroll activities while providing the necessary support.

FreshPay’s mission

The mission of FreshPay is to empower accountants with the tools they need to run their business better and scale easily. FreshPay aims to provide innovative payroll management software that is easy to use and helps companies run payroll in a simpler, more efficient manner. FreshPay helps companies reduce the time required to run payroll through automating processes and eliminating manual steps. It makes life easier for less experienced accountants by capturing and correctly processing edge cases that might otherwise have been missed.

OUR WORK

Project Management

UX & UI

Frontend

Backend

QA

Discovery Phase

PURPOSE OF COOPERATION

Automation of the existing employee payroll processes for companies operating under UK law

THE CHALLENGE

Developing comprehensive software for automating payroll processing for accountants, employers and employees in the UK

1. PROCESS

The beginning of the cooperation between Railwaymen and FreshPay dates back to 2021, when the client approached us to develop payroll software that would enable them to quickly and conveniently calculate employees' wages based on UK laws. Because the current payroll process is very detailed, and competing software was developed several years ago, there was a need at FreshPay to create a solution that would meet the business needs. The project was created with the idea of reorganizing the existing procedure and at the same time making the existing work of accountants, employers and employees themselves as easy as possible. The FreshPay project, due to its size and complexity, was created by a relatively large team. Depending on the intensity of tasks, the team composition included 1 Product Manager, 1-2 Front-end Developers, 3-6 Back-end Developers, 1-2 QA Specialists, 1-2 UX/UI Designers.

TIMELINE

The cooperation on the Freshpay project began in March/April 2021. After learning about the client's expectations and conducting an initial workshop, we began work on developing the payroll management solution. However, before we undertook any activities we set their direction based on the Discovery Phase. Exactly one year after the start of joint activities, we were able to release version 1.0 of the application to the world.

April 2021

workshops 0

with the client

July 2021

start of development

(Discovery Phase)

March 2021

obtaining HMRC

certification

April 2021

product release

April 2021

workshops 0

with the client

July 2021

start of development

(Discovery Phase)

March 2022

obtaining HMRC

certification

April 2022

product

release

Workshops 0

We conducted an initial workshop with Freshpay clients before the official cooperation began. During this phase, we focused mainly on mapping the idea and systematizing the various stages of project work. Using the Miro tool, we were able to lay out everything in detail and set the goals and objectives for the first activities of the project. As a result, we compiled a list of accounting-related documents that were necessary to work on this project and visualized the dream vision of the payroll management software according to our clients.

The crucial goal of the clients was to develop a tool that would be more composable than the payroll software available on the market at the time. An additional motivation was to prepare a solution that would not only affect office accountants, but also be of use to other types of users like employers and employees. These activities were aimed at digitizing the existing workflow entirely.

Initial plan

According to the initial plan, the client wanted to create a payroll solution tailored to different types of users, which would allow convenient access and exchange of all payroll data online. The purpose of moving elements of the process online was to streamline it and at the same time facilitate the existing work of accountants. An equally important aspect of the development was to work on the flow of data to the relevant offices so that any manual data could be easily delivered to the designated institutions. The initial plan also included integration with external APIs in order to maximally automate the flow of information.

Milena, QA Team Lead

“From my point of view, FreshPay was a challenging project in terms of legalities. In order to be able to work on any part of it, we had to be constantly up to date with the legislation, especially since the data posted in the software is directed to institutions such as the HMRC, and any mistake could be costly.”

DISCOVERY PHASE

User Profiles

In the Discovery Phase process, we established user-profiles and analyzed the needs of each of these personas. While doing audience analysis together with the client it turned out that the automation of work on payroll included not only HR/accountants and offices but also communication with company owners (who approve payroll and provide information to them) and employees (who can see the data and download the documents).

Product Value Canvas

After considering the users we moved on to analyzing the client’s ideas for improvements to the current process. To this end, we prepared a Product Value Canvas to review the problems of each user and evaluate our options for solving them.

As a part of competitor analysis, we conducted an in-depth screening of processes using competing tools, during which the client set payruns in software from other vendors. By learning more about the tools available on the market, we were able to detail positive functionalities, as well as shortcomings that software from FreshPay could solve.

Processes Mapping

The most labor-intensive part of the Discovery Phase was certainly the mapping of processes to better understand relationships between data, their arrangement on the timeline, points of contact with authorities, and the need to process or generate specific documents and employee data at a specific time. We paid a lot of attention to the communication aspect, so Business Process Model and Notation (BPMN) proved to be a useful tool, which allowed us to analyze each path in detail and do a lot of data analysis from HMRC documentation, letters, etc. This kind of modeling showed us how complex the system under development is and how difficult the form of payroll billing itself can get.

Functionalities Prioritizing

The information gained during the Discovery Phase allowed us to divide the functionality by priority and systemize knowledge including even the rarest scenarios. Together with the clients we analyzed each work item and developed a project backlog. The Discovery Phase, due to its sophistication, took about 3 months.

MVP

Working on the MVP was no small challenge due to complexity of the project. Even the most basic version of it will need to provide a lot of functionality. For us, this meant that the set of bottom-line minimally essential features, which was large at the beginning of software development, grew as we gained more insights into the operations necessary to perform payroll calculations correctly.

The creation of the MVP was limited by a deadline of April 6, 2022, when the next tax year began in the UK. By then, our task was to develop a system that is capable of generating a payroll document and handling basic payroll. During the preparation of the MVP, in addition to providing the necessary functionality, our attention was consumed

Clare Haynes, Co-Founder, FreshPay

“During the discovery phase when we gave the brief of what we were looking for, RWM came back with a wireframe that immediately realised our vision. A step by step wireframe showing what each step should potentially be was shown in a way that really demonstrated their understanding of what we required the software to do. This and our initial conversations were of a much higher standard than other developers we spoke with.”

2. The Features

HMRC Certification

A very important step throughout the project was to integrate the posted data into the payroll software and be able to share it between the relevant institutions, and in particular to HM Revenue and Customs. In March 2022, FreshPay received the certification granted by the aforementioned authority. This document confirms that the software created is fully compliant with the current pension program. This is particularly important for entities providing pension processes.

Cooperation with HMRC is not limited to sending documentation. The institution also provides useful information related to the change of tax codes, or data on users’ financial obligations in the form of a loan. This integration makes the exchange of information between HMRC and the company seamless and structured.

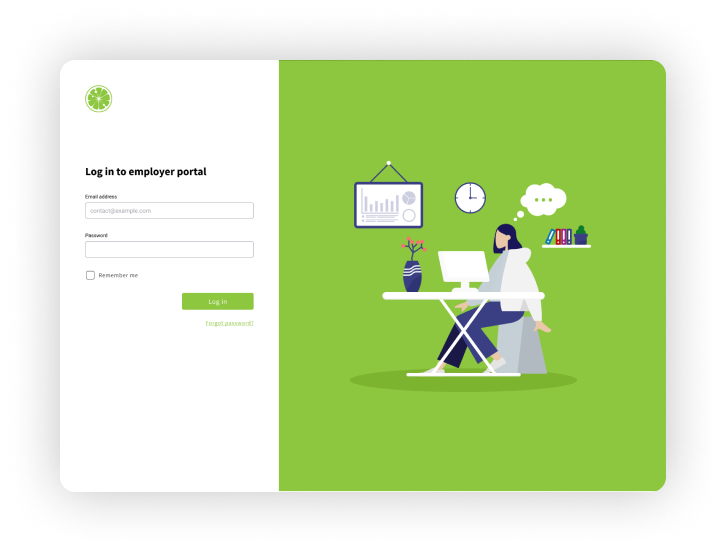

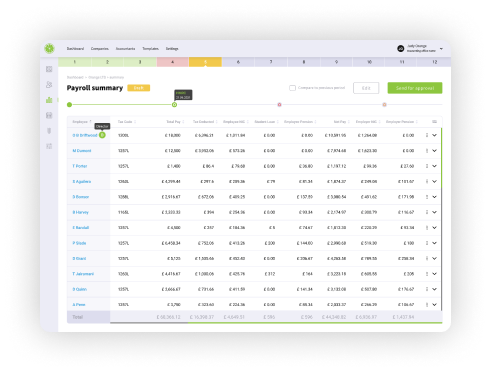

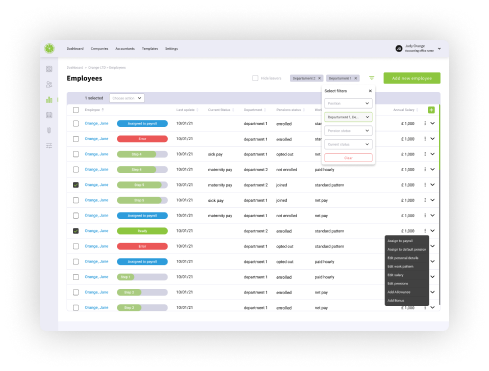

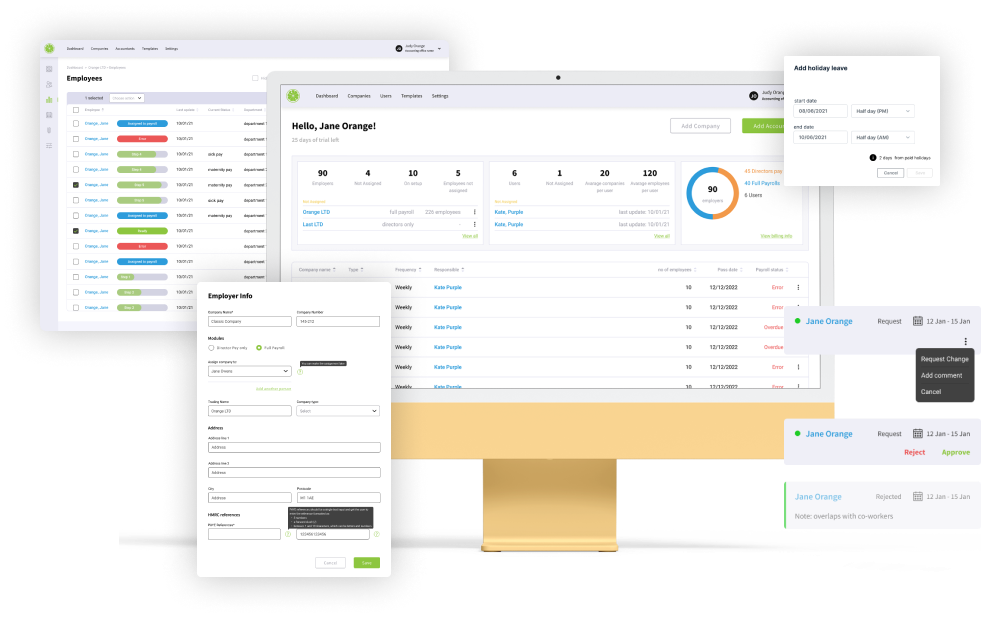

Employer and Employee Services

This functionality allows both employers and employees themselves to view the system and access necessary payroll data. Users can log in to the system as well as invite more people to use the system. After each closed accounting cycle, those with access to the platform can view a large number of useful reports generated based on key guidelines. In the case of employees, these include payslips and pension letters, which indicate eligibility for pension contributions. Accountants and employers, in turn, receive documentation and statements that are sent to the tax office.

Publishing documents to Xero

Thanks to the integration with Xero we are currently working on (Xero is a piece of accounting software that streamlines client verification), publishing documents will not be a problem. Systematic reporting in Xero, which is an accounting system, we send payroll cost data. This goes to Payroll Journals, so we send the payroll data, and thus streamline their accounting. Reporting in Xero allows us to quickly catch any irregularities in the accounting process and make the necessary corrections. We want both payroll accounting and all payments to be available to FreshPay software users in the near future.

Integration with PensionSync

Due to conditions in the UK related to pension, there are multiple pension providers in that area. Each has individual rules for reporting (e.g., by sharing APIs, sending CSVs) what an employee contributes to his or her pension. That’s why, in the case of FreshPay, we partnered with pension systems integrator PensionSync. Its job is to deliver information about an entity’s pension contributions to the appropriate places in no-time.

CIS Module

CIS module (Construction Industry Scheme) is responsible for accounting for counter contract employees, companies that work with other companies on the basis of invoices. This functionality was created for permanent personnel, who are affected by additional, more specialized billing guidelines.

CREATING PAYROLLS

This feature is responsible for the ability to simply attach new employees to the system based on data collected in another system. Thanks to data automation, it only takes a small amount of work to import information about each employee, without having to complete everything manually, which can take even several days to make it work properly.

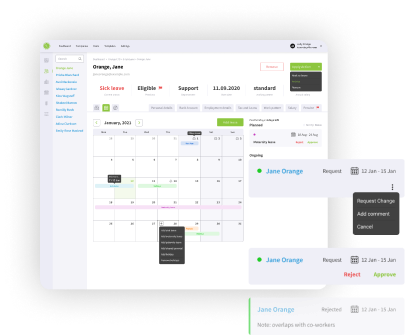

Holidays and Absence Calculator

This option allows users to calculate their leaves according to the applicable criteria. In addition, any leave issues take into account not only the type of leave, but also the possibility of state funding depending on the qualification processes in place in the UK.

Piotr, Senior Ruby on Rails Developer

“From my perspective, FreshPay is a project that requires a lot of accuracy. Together with the entire project team, we had to supplement our knowledge so that everything was implemented according to the law. An additional challenge was working on all (even the least likely) payroll calculation scenarios. As a result, we were able to create software with no limitations.”

3. TECHNOLOGIES & TOOLS

4. UX / UI

Professional Approach to the Interface

While analyzing the solutions offered by competitors together with the client, we came to the conclusion that we wanted to distinguish ourselves by the speed of moving through the application and to develop solutions tailored to both standard users and those with large amounts of data. We have paid a lot of attention to streamlining the communication process between the various users of the system so that it runs as smoothly as possible without any speed bumps or choke points.

Language for Design Process

Due to the nature of the project, we had to learn how to use a language for process design, as the interface does not necessarily show all the data, time and sequence dependencies of the process. Therefore, to better understand the process we used BPMN. We analyzed the available data on the official sites in the UK government, and then tried to order it all taking into account the necessary conditions.

Preparation of elements for the interface

At this stage, the key issue was to prepare the right flow in terms of UX. In addition, we collected useful information on how this interface should look like. After analyzing the collected materials, we moved on to creating the UI. To this end, we developed a suitable design system, which includes useful elements like archetype forms, table templates, navigation, etc. This allowed us to work in parallel in the UX/UI area.

Sylwia, UX/UI Designer Team Lead

“The challenge in the project was to understand the process we support and translate it into a complete interface. Through simplified process modeling, we were able to understand their time and data dependencies. The next step was to overlay the legal dependencies. Then we were able to group and present the data so that it was easily accessible at the right times.”

5. QA

Testing FreshPay turned out to be a big challenge, because in addition to the huge amount of data and the dependencies between these data (which cause a huge number of test cases to be covered), we also had to keep in mind the user, who should move through the application with ease and understanding. The whole team was involved in testing: functional and non-functional tests were performed by the testers, the UX department carried out usability tests, while the clients were involved in acceptance tests.

From the beginning, we also relied on solid documentation. Preparing a test strategy and test plan paid off as the project grew. It was also essential to prepare test cases and prioritize them. Documentation guaranteed us an orderly testing process.

All these activities allowed us to be sure that we offer users a stable and well-functioning application. The next step we are planning is to implement automated testing, which will improve and speed up regression testing and thus optimize the testing process.

FINAL PRODUCT

RESULTS & FURTHER DEVELOPMENT

The collaboration with FreshPay resulted in the development of payroll software that significantly simplifies existing payroll solutions. Automation and digitization mean that data can be accessed by each stakeholder, be it the accounting office, employers or employees. FreshPay is a tool that addresses all needs unmet by competing accounting solutions.

Testimonial:

We are very happy with the application and its overall look. We had a vision of what we wanted the payroll application to perform but not really a vision as to how it would or should look.

Railwaymen have really brought our vision to life in a way we were not able to visualise.

Clare Haynes,